Opening Our Hearts to Others: Exploring Loving Kindness

With Paula Chichester & Lou Beaumont: 7th & 8th November 2020

We all know the wonderful feeling that comes when someone sincerely offers to help us with no expectation of return; or when we see people genuinely giving their time and money to make a better life for another person or a whole group of people. We also know how good it makes us feel when we freely share our time and resources with others —when we are kind. Kindness makes us happy. For some people, kindness comes quite naturally to our friends and family, but not to strangers or people we judge as different. We can learn techniques that inspire us to think and act with more kindness, that cultivate an attitude of tender concern for the welfare of ourselves and all beings. In this workshop, we explore our own attitudes, look at our limitations and see how easy it is to cultivate kindness and feel more satisfied and joyful in our lives.

The concept of loving kindness

-

The positive effects of kindness

-

The view of kindness being a weakness

-

The skill of understanding what others need from us

-

The courage to be kind

-

Recalling times we have been kind and when others have been kind to us

-

The positive effect of putting others before ourselves

-

How kindness leads to happiness

-

What stops us being kind?

-

Equanimity

-

The importance of self-love

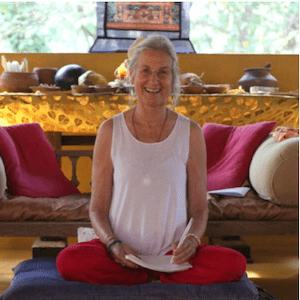

About the Leaders

Paula Chichester’s study and practice of the wholistic approach to healing body, mind, spirit and planet began in the late 1960’s when she first became aware that industrial society and over population is crushing human connectivity to our planet, to other beings and to ourselves— and how this impacts our well being. She has spent her life studying spiritual wisdom of all traditions, physical and psychological healing methods; emphasizing experiential exploration of healing the whole person through energy body/mind movement and meditation, art exploration and recreation in wild landscapes.

Lou first came to yoga in her early twenties & has been practising hatha yoga & pranayama for many years. She is a qualified Wheel of Yoga teacher & has been fortunate to have special instruction from a great teacher on classical pranayama which she would very much like to share with you.

She started Tai Chi classes, in Spain where she lives about ten years ago with her teacher a student of the Spanish lineage holder of the Hun Yuan style. The chi gong she will be showing you is from that school which has a flowing, gentle style which anyone can easily practice enjoy & benefit from.

Audio and Video from Zoom Sessions

Session One

Session Two

Session Three

Session Four

A Way to Say Thank You

Please use the form below if you would like to make an offering to Land of Joy as a thank you for making these resources available. Any offering will be a big help and very gratefully received as the unexpected closure of the centre is having a big impact of our finances. However, we very much appreciate many people are experiencing economical and financial challenges during these unpredictable times and therefore might not be able to support us at the moment.

Thank you and may you be entirely happy.

The form is not published.